The 1000 World's Largest and Strongest Banks Rankings is an annual assessment of the financial and business performance of the banking industry. Since 2007, TAB Global has published the most authoritative annual ranking of the strongest banks in the Asia-Pacific region. In 2023, the rankings expanded to include the world’s 1,000 largest and strongest banks.

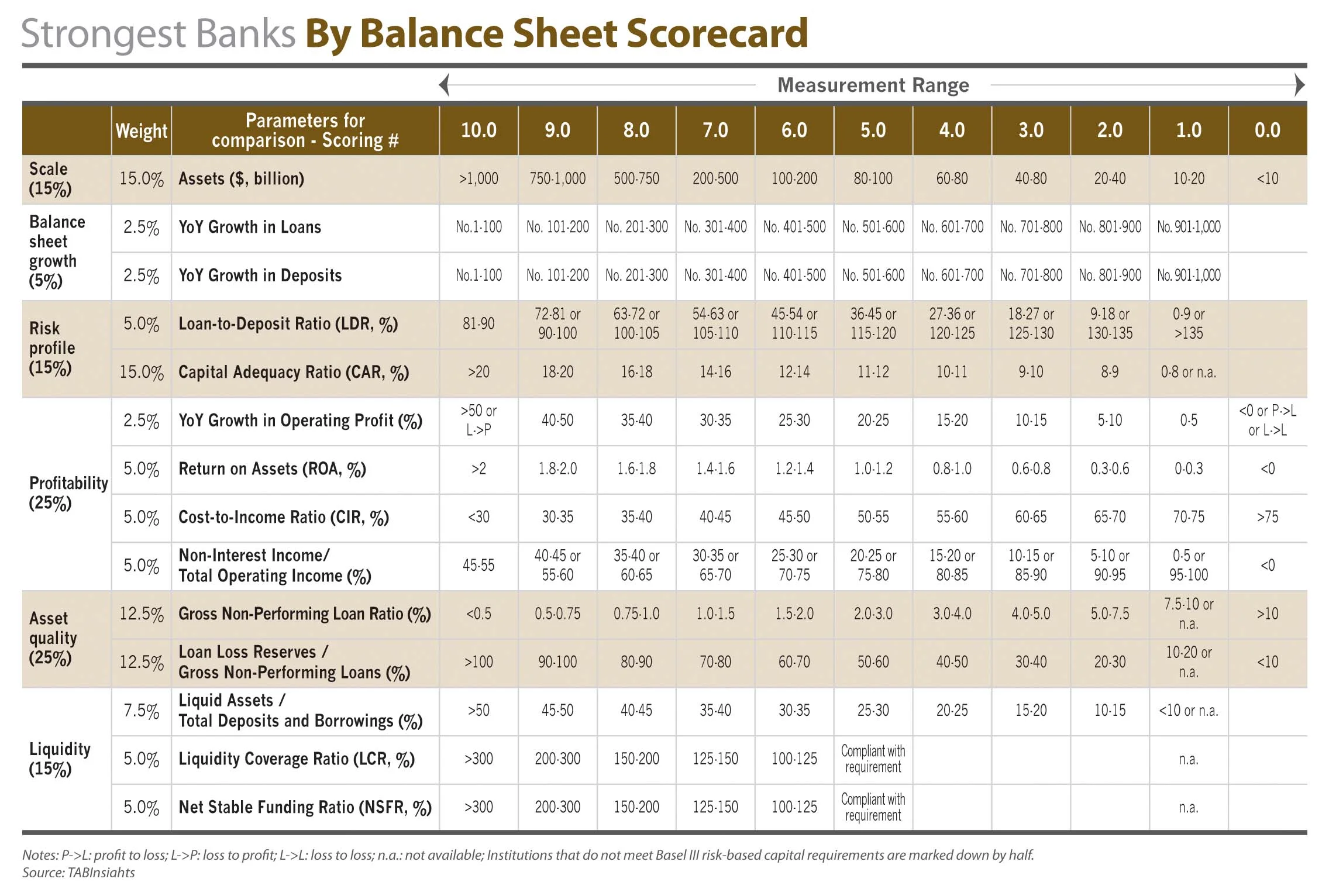

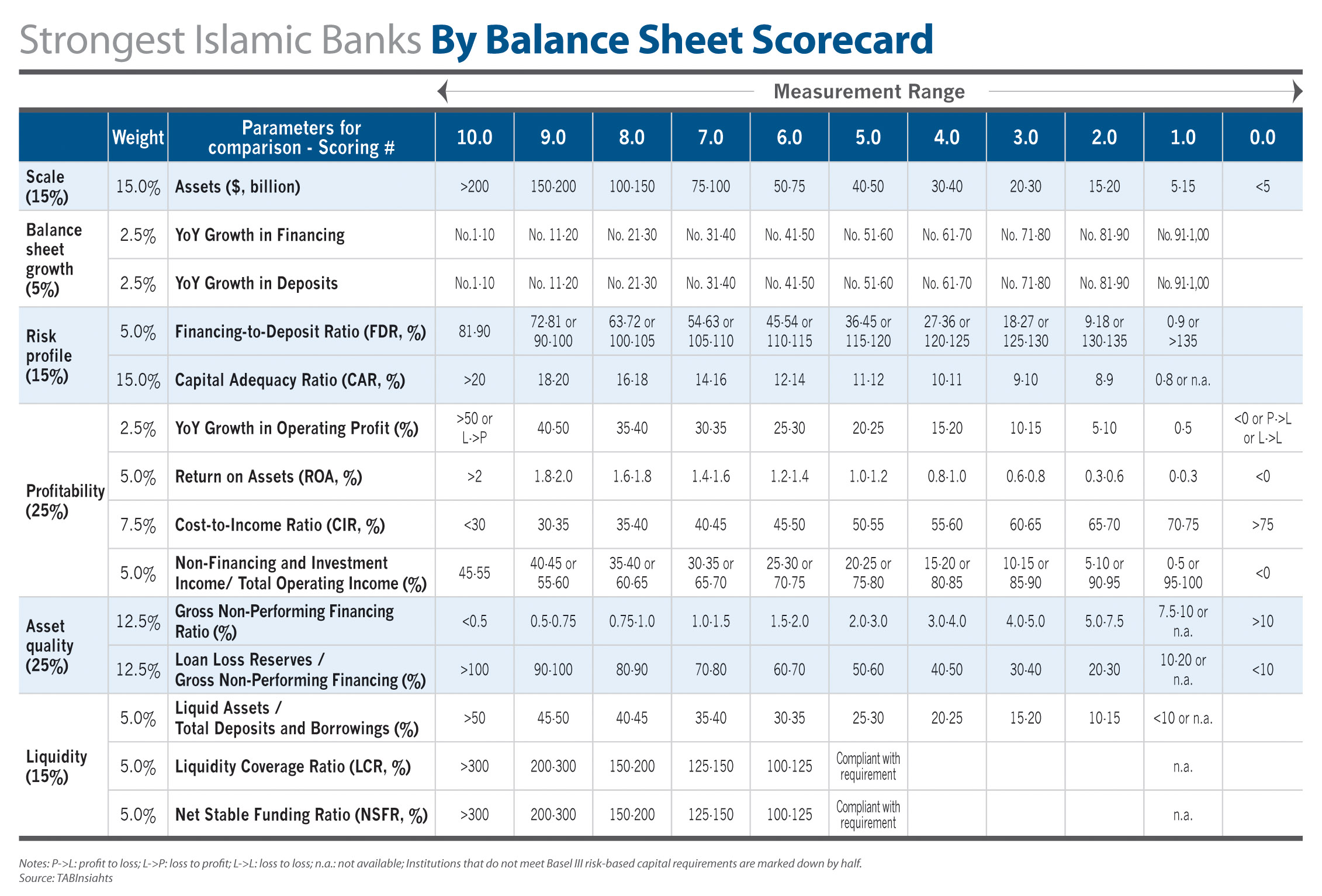

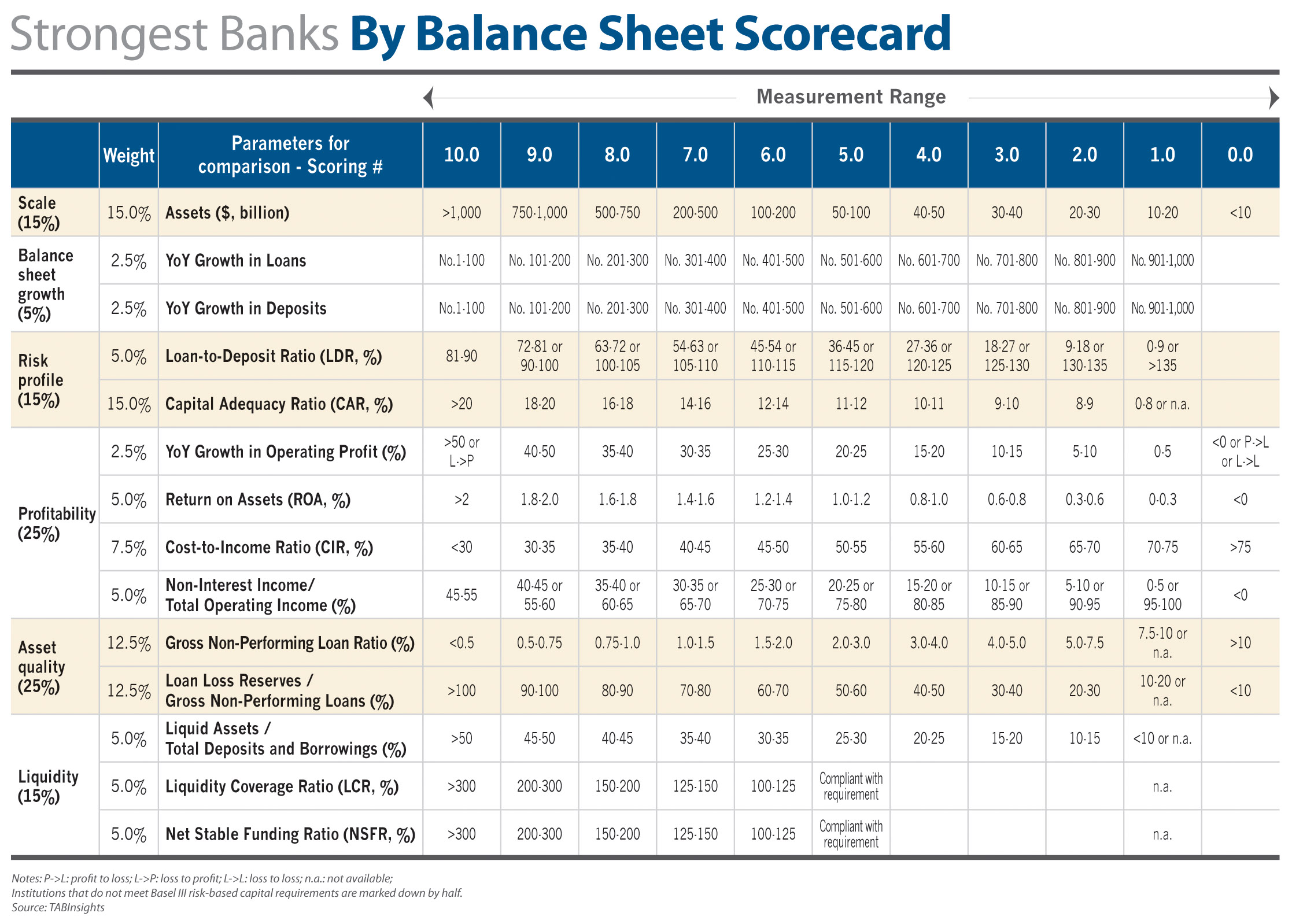

The rankings are based on a detailed and transparent scorecard, evaluating banks and financial holding companies according to six key criteria related to balance-sheet performance, with a focus on financial strength and sustainability. These criteria include scale, balance-sheet growth, risk profile, profitability, asset quality, and liquidity, covering 14 specific factors.

The rankings help banks and corporations assess the quality of counterparties for credit, transactional, and trade purposes, improving evaluations of counterparty and balance-sheet risks. The rankings provide a comprehensive view of institutions' balance-sheet growth and profitability amid varying economic conditions.

Covering all major global regions—Africa, Asia-Pacific, the Caribbean, Central America, Europe, the Middle East, North America, and South America—the assessment includes banks and financial holding companies engaged in significant banking activities. It excludes central banks, policy banks, and finance companies. The evaluation takes place between March and August each year, aligning with the availability of annual financial results for banks and financial holding companies.

Evaluation Criteria

The evaluation is based on a rigorous quantitative assessment of the financial performance of banks and financial holding companies during the review year. We evaluate performance using six critical indicators, weighted according to their importance:

To access the Rankings of the Strongest Banks by Balance Sheet, please click here. click here