Banks are confronting the limits of outdated cores, focusing on structural modernisation towards modular and scalable architectures. Competitive pressure—as well as collaboration opportunities—from tech-led digital-only challengers is growing. TABInsights data shows that in 2024, 40% of total digital banks and 20% of the global fintech pool was based in APAC. Rising demand for personalisation and real-time capabilities is pushing incumbents to view modernisation as central to growth. The emphasis is on building technology that adapts quickly, allowing institutions to respond faster to market changes, regulatory requirements and evolving customer needs.

Tech spending rises as modernisation gathers pace

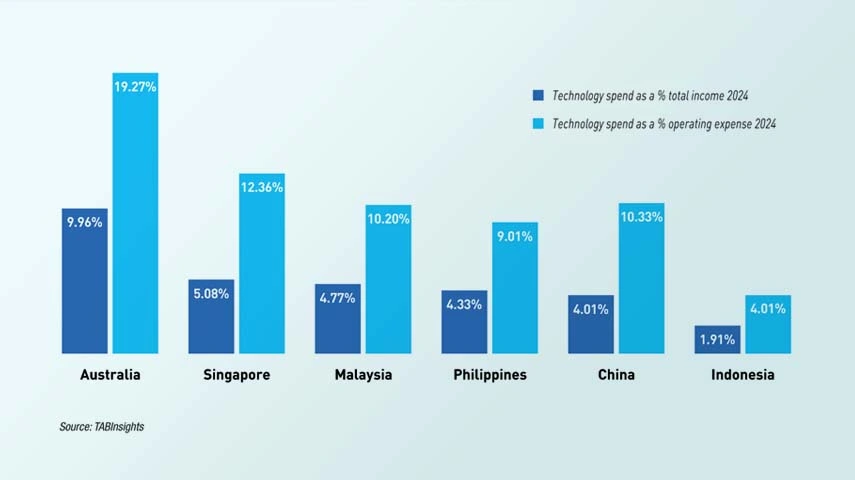

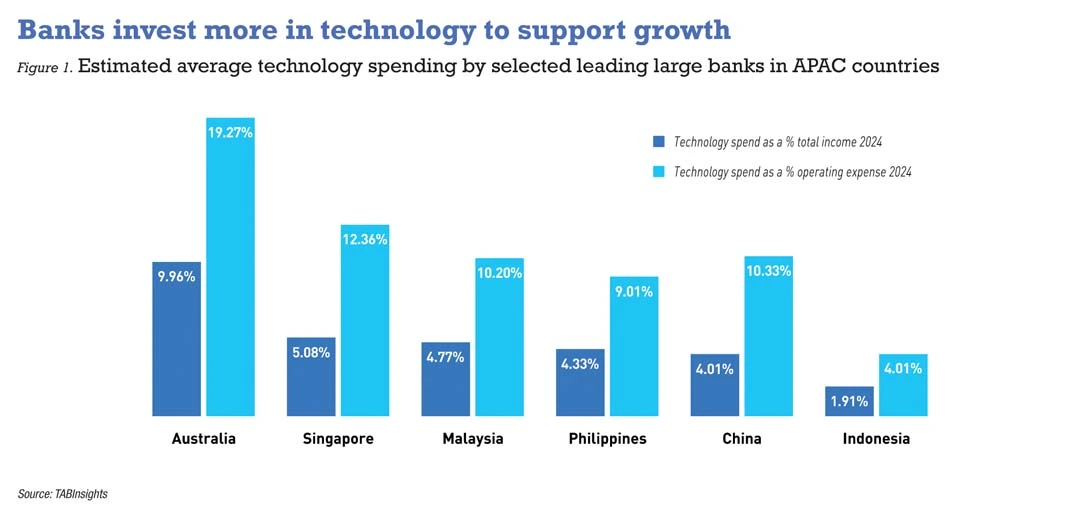

TABInsights research shows that leading large APAC banks are spending on average about 5% of total income on technology, led by markets such as Australia and Singapore.

While banks often allocate over 50% of their technology budgets to operating costs (‘run the bank’), leading institutions are steadily increasing their investment in transformational initiatives (‘change the bank’). More banks are directing capital into the core foundations of digital competitiveness—data infrastructure, cloud platforms and resilient systems. Scale, speed of innovation and operational reliability are emerging as defining differentiators. They seek to integrate into ecosystems, embedding solutions into both customer and internal journeys.

Pivoting to scalable cloud foundations

As banks rethink their technology stack, scalability and agility in innovation have become paramount. At Vietnam-based Techcombank, chief digital officer Pranav Seth explained, “We have built on three core pillars: digital, data and talent, backed by a $500 million investment.” The bank rewired its architecture for cloud-native scalability, enabling its digital engagement platform for retail and small and medium-sized enterprise (SME) clients. A modern data lake and ‘data brain’ now support advanced analytics. “We have developed in-house artificial intelligence (AI) capabilities, leveraging generative and predictive AI to enhance engagement and drive automation,” Seth added.

Tien Phong Commercial Bank (TPBank) has taken a similar foundational approach. “Our focus is AI-first, data-driven and cloud-ready. ‘Data first’ has been our motto for the last two years,” said Bui Xuan Truong, digital technology director. It’s new microservices-based core has significantly increased transaction speed and concurrency. Since migrating retail banking systems to the private cloud, TPBank has achieved 2.2 times annual growth in customers and transactions, while maintaining the same operational team size. “We saved at least 60% of hardware investment. “From now on, everything new we buy will be microservices-based and cloud-ready,” Truong added.

Beyond cloud foundations, banks are also addressing the challenge of legacy cores.

Rethinking core architecture

Leading banks are embarking on large-scale shifts to modular architectures and agile cores. Legacy platforms still act as structural barriers—slowing growth, constraining agility and adding to technical debt. While smaller or digital-first players may attempt full replacement, incumbents with complex estates tend to prefer phased modernisation over the risks of a full “rip and replace”.

Voranuch Dajakaisaya, executive chairman at Kasikorn Bank Technology Group (KBTG), described their measured approach. “Instead of a full core replacement, we opted for an interim solution, adding a new host to double the capacity and drive scalability. We’re reviewing our entire lending portfolio, reducing redundant processes and replacing outdated platforms while emphasising API-based integrations for better scalability.”

Rising transaction volumes amplify the urgency for change. “In 2024, our daily transactions increased around 35% compared to 2023,” said David Formula, chief information officer, Bank Central Asia. The bank strategically modernised its infrastructure to improve its performance. It unwound monolithic system into microservices, adopted micro front-ends and distributed databases, and transitioned to more scalable solutions. “We introduced new logical partitions within the core banking to separate different workloads and optimise the system. We also implemented a private cloud shared across subsidiaries,” he added. By 2026, the bank plans to split core infrastructure into separate units. “We’re moving to a system where we’ll have two active machines and one backup machine, allowing us to double the transaction capacity,” Formula explained.

Banks are also taking a lean-core approach by moving out applications outside the main system. RHB Bank’s chief digital officer Cyrene Kong explained: “We’ve hollowed out the core by moving statements, product innovation and product bundling outside the core system. This allows us to focus on what matters most while improving flexibility and speed.” She added: “Our goal is to make the stack more immutable, avoid platform lock-ins and even make it more polyglot in the future.”

Vendor lock-in remains a broader industry concern, as over-reliance on technology partners can limit flexibility and raise long-term costs.

The idea of a single, all-purpose core is also being reconsidered. TPBank is exploring a dual-core model to balance responsiveness with resilience. In Indonesia, Rully Fernata, senior vice president of IT strategy and governance at Allo Bank, said they operate two cores—for wholesale and retail. They developed internal composable services to bridge them, accelerating development and reducing vendor friction.

While larger incumbents adopt phased approaches, newer banks are opting for full-stack transformations.

Vietnam Maritime Commercial Joint Stock Bank (MSB) replaced its legacy mainframe with a cloud-native, open-architecture platform, achieving a fivefold increase in daily transaction volumes and a tenfold rise in throughput. In Hong Kong, Fusion Bank completed a full-stack, cloud-native core replacement within ten months, achieving high uptime, cutting time to market and reducing technology costs.

The new banking mandate

The lesson from leading banks is clear: modernisation is not merely an IT upgrade but a business mandate. They must prepare for future scalability, greater compute capability and an AI-driven future. Institutions are taking different routes to upgrade the tech stack—hollowing out cores, building dual platforms or going full-stack—but the common thread is urgency. In APAC, competitiveness will be defined by how quickly a bank can reconfigure its architecture to meet new demands. Those who treat modernisation as a growth engine will turn technology into their fastest-moving advantage.