Banks are losing strategic control over the points where users access financial services. Digital users no longer engage financial systems through bank-owned channels. Instead, they enter through social platforms, embedded services and virtual environments. Infrastructure no longer transmits value passively. It now executes logic and decisions. Artificial intelligence (AI) no longer plays a supporting role. It is becoming an autonomous delegate that makes choices and performs tasks at scale.

These shifts are converging to reshape the foundation of financial trust, value exchange and institutional relevance. Large balance sheets and regulatory advantage are no longer sufficient to protect incumbents. Strategic relevance now depends on how effectively a bank integrates into decentralised platforms, embeds programmable trust mechanisms and applies AI governance with transparency and intent.

Digital fragmentation is reshaping how users form financial identity and place trust

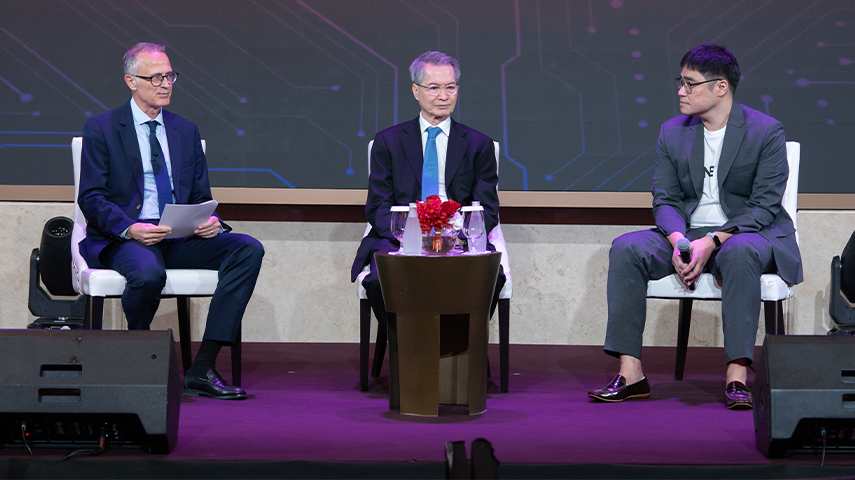

The coherence once maintained by branch networks, national standards and shared institutional norms is weakening. “Today’s world is fragmented,” said Kris Lerdchanapornchai, head of product at LINE BK. “Young people grow up without a shared narrative. Nobody controls the conversation anymore.” Users no longer develop financial identity through stable institutions. They build it across content ecosystems, peer networks and messaging platforms.

This fragmentation represents a structural shift, not a cyclical trend. “Serving the unbanked means reaching them where they are, not pulling them into traditional banking channels,” Lerdchanapornchai explained. LINE BK delivers payments, credit and savings services inside the LINE messaging application. This platform-native strategy aligns financial offerings with user behaviour, not institutional design.

Banks must treat digital ecosystems as primary engagement environments, not as extensions of legacy systems. Financial services must be portable, interoperable and meaningful across diverse contexts. Brand recognition and regulatory licence no longer guarantee trust. Institutions must build credibility inside each platform through contextual relevance, responsiveness and frictionless user alignment.

Programmable infrastructure is transforming product logic and value creation

Financial infrastructure is evolving from passive rails into programmable engines. Systems that once moved data or money now embed executable logic, dynamic rules and adaptive responses. This transformation enables composable financial systems that interact across platforms, adjust to user inputs and reduce friction in delivery.

“Once the infrastructure becomes programmable, the products and business models will naturally evolve. That shift is unavoidable,” said Charamporn Jotikasthira, executive director of Bangkok Bank. “We are moving into environments where physical money is irrelevant. Users expect systems that are interoperable and traceable.” Tokenised assets, embedded compliance and decentralised protocols no longer represent speculative fringe developments. They reflect a broader redesign of how value is created and exchanged within digital systems.

Users already assign meaning to virtual credits, loyalty points and digital tokens in gaming platforms and social ecosystems. “We are moving into environments where physical money is irrelevant. Users expect systems that are interoperable and traceable,” Jotikasthira added.

The implications for banks are structural. Infrastructure must be designed not only for speed and efficiency, but also for transparency, composability and autonomous action. Institutions must determine whether to build proprietary programmable systems, connect to third-party platforms or assume a governance function across multi-party networks. Each path affects how institutions influence outcomes, manage risk and define their role in distributed ecosystems.

Agentic AI is reshaping institutional memory and execution logic

AI has expanded from task automation into autonomous agency. Generative and agentic models simulate judgement, initiate actions and interact directly with users and systems. These models enable banks to retain knowledge, act consistently and operate at scale with lower marginal cost.

“Much of the white-collar economy is being replaced by artificial intelligence,” Jotikasthira observed. In trade finance, tasks that once relied on legal training, document verification and relationship memory are now modelled in code. “You train the model with data, and it remembers everything. It doesn’t forget.”

Unlike human staff who leave, rotate or forget, agentic AI preserves institutional memory over time. It detects anomalies, assesses counterparties, applies compliance rules uniformly and generates actions aligned with policy. These capabilities increase speed and consistency but introduce new accountability challenges.

Banks must redesign compliance, oversight and governance for environments where AI acts autonomously. Decision rights, ethical limits and exception handling protocols must be embedded directly into models. Agentic AI is no longer a background tool. It has become an institutional actor whose decisions carry operational and regulatory consequences.

Institutional coherence is critical in fragmented, programmable ecosystems

Fragmentation, programmability and agency converge to place pressure on institutional coherence. Products, systems and decisions may no longer operate uniformly across jurisdictions, platforms or user contexts.

“You need a stable society with strong legal order. Without that, you risk falling back into disorder,” Jotikasthira warned. Technological innovation alone cannot guarantee operational success. It must be matched by legal clarity, enforceability and cultural legitimacy. A smart contract offers no value if it cannot be interpreted or enforced in the relevant jurisdiction.

Resilient institutions are those that coordinate across fragmented infrastructures, regulatory systems and partner ecosystems. Banks must build systems that remain functional under stress, evolve with compliance requirements and interoperate with adjacent platforms.

This demands more than digital transformation. It requires architectural alignment, cross-functional governance and deliberate organisational design. Institutional coherence must be achieved not through uniformity, but by aligning intent, rules and structure across complexity.

Strategic resilience depends on clarity of role and disciplined design

As platforms grow, agents become more capable and systems more programmable, technological capacity will continue to rise. The institutions that lead will not be those that adopt innovations first, but those that define their roles with clarity and build systems to support that role.

Agentic AI cannot restore lost legitimacy or compensate for weak purpose. Governance must protect against operational risk and strategic drift. Institutions must determine where they create value, how they anchor trust, and what role they serve within systems they do not fully control.

Leading institutions will combine architectural readiness with disciplined restraint. They will embed trust into system logic, empower users without losing oversight and scale intelligence without compromising principles.

Resilience, relevance and trust will not flow from historical advantage. They will emerge from clarity of purpose, discipline in execution and alignment between institutional intent and systemic design.