Global Islamic banks have sustained double-digit asset growth and rising profitability, according to the TABInsights 2025 Largest and Strongest Islamic Banks Rankings. The assessment covers the 100 largest full-fledged Islamic banks and financial holding companies worldwide for the financial year (FY) 2024, with a cut-off date of March 2025.

Rooted in Shariah compliance, risk-sharing and asset-backing, the Islamic banking industry continues to expand, supported by solid deposit mobilisation, network expansion, innovative financial instruments and government backing. Institutions have grown both in scale and complexity, forming business models aligned with regional market structures and regulatory frameworks.

The Middle East remains the dominant force, with an unmatched asset base supported by oil wealth, Shariah-compliant finance and mature retail ecosystems. Asia has emerged as a dynamic growth hub, shaped by Malaysia’s advanced dual financial system, Indonesia’s expanding financial inclusion and Pakistan’s policy-led transformation that supports ongoing progress and operational improvement. Africa and Europe, though still at earlier stages, are gaining momentum as more banks lay the groundwork for Islamic finance in these markets.

The Rankings capture not only financial performance but also governance insights in risk management, capital planning and sustainable growth across markets. Leading banks illustrate how disciplined governance supports financial outcomes and resilience. Effective board oversight has become increasingly important for managing evolving risks and safeguarding long-term sustainability.

Global Islamic banking maintains momentum and rising profitability

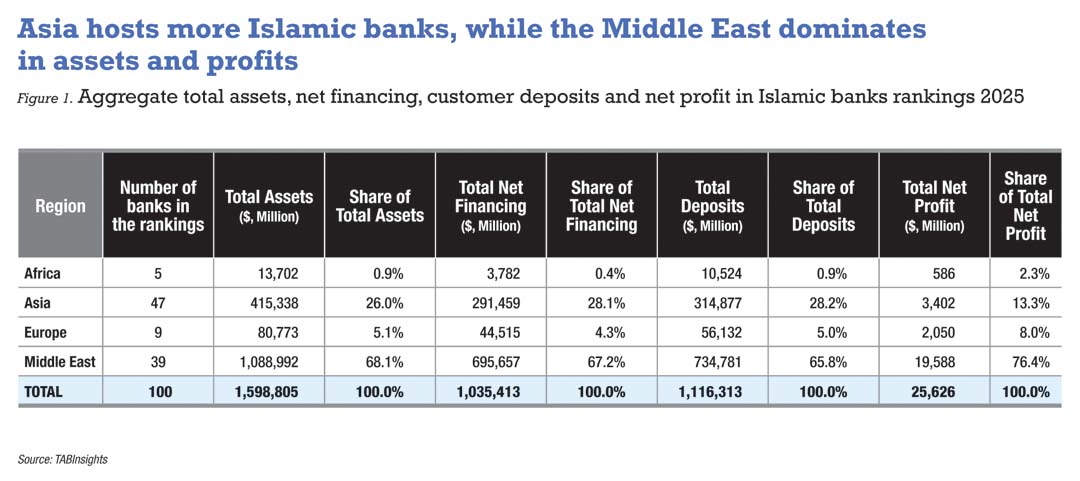

The 100 largest Islamic banks collectively held $1.6 trillion in assets, $1.0 trillion in net financing and $1.1 trillion in customer deposits as of FY2024. This follows steady expansion in recent years, with total assets rising from $1.2 trillion in FY2020 to $1.5 trillion in FY2023, signalling sustained sector growth despite a smaller scale compared with conventional banks. Combined net profit for these banks also increased from $11.4 billion in FY2020 to $25.6 billion in FY2024.

The ranking covers 47 banks from Asia, 39 from the Middle East, nine from Europe and five from Africa, all with publicly available FY2024 data. It highlights the continued prominence of the Middle East and Asia in Islamic finance, despite differences in profitability, asset mix and market maturity. This year’s assessment spans 24 countries, including 10 in the Middle East, eight in Asia, evenly split between Southeast Asia and South Asia, and three each in Africa and Europe.

Global Islamic banking has sustained its growth momentum, with scale and profitability rising steadily in recent years. Expansion has been supported by robust deposit mobilisation, network growth, financing and investment portfolio development, and favourable regulatory conditions across key markets. In the Middle East, economic diversification initiatives and strong oil revenues have strengthened banks’ investment and financing activity, while in Asia, Islamic banking penetration is increasing in predominantly Muslim markets such as Indonesia and Malaysia, alongside advancing market maturity in countries like Pakistan.

Weighted average asset growth for the top 100 banks rose from 11% in FY2023 to 11.7% in FY2024, led by major institutions including Al Rajhi Bank and Maybank Islamic. Middle Eastern banks saw growth accelerate from 8.0% to 11.0%, while Southeast and South Asian banks advanced from 7.4% to 9.5%.

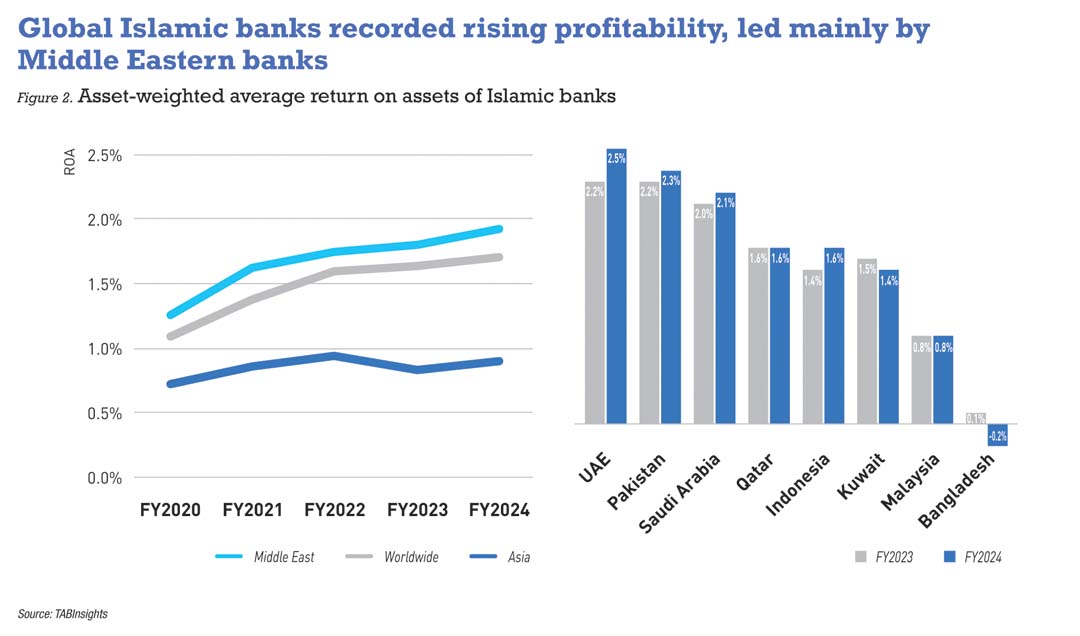

Profitability has improved across global Islamic banking, led predominantly by Middle Eastern markets, with the asset-weighted average return on assets (ROA) of the top 100 Islamic banks rising from 1.1% in FY2020 to 1.7% in FY2024. The Middle East consistently outperformed Asia, with average ROA increasing from 1.3% to 1.9%, supported by scale, lower funding costs, mature regulatory frameworks and broad market acceptance. Asian Islamic banks operate on a smaller scale, face higher funding costs and regulatory constraints, and experienced lower profitability, with average ROA fluctuating between 0.7% and 0.9%.

In FY2024, the United Arab Emirates (UAE), Pakistan and Saudi Arabia led with ROAs of 2.5%, 2.3% and 2.1%, respectively. Qatar and Indonesia performed well at 1.6%. Islamic banks in Malaysia, despite its long-standing experience in Islamic finance, saw ROA remain at 0.8%, constrained by structural challenges such as high sensitivity to interest rate changes due to a lower share of low-cost deposits, relatively high operating costs, intense market competition and product homogeneity. Rising deposit rates, fierce competition for household financing, and deposit growth lagging behind financing expansion further pressured net financing margins.

Middle East retains lead in scale and profitability

The Middle East continues to dominate Islamic banking in both scale and profitability, even though Asia hosts a larger number of institutions. Middle Eastern banks account for 68.1% of the total assets of the top 100 Islamic banks, compared with 26.0% held by Asian banks. Their dominance is even more pronounced in profitability, contributing 76.4% of total net profit while Asian peers account for just 13.3%.

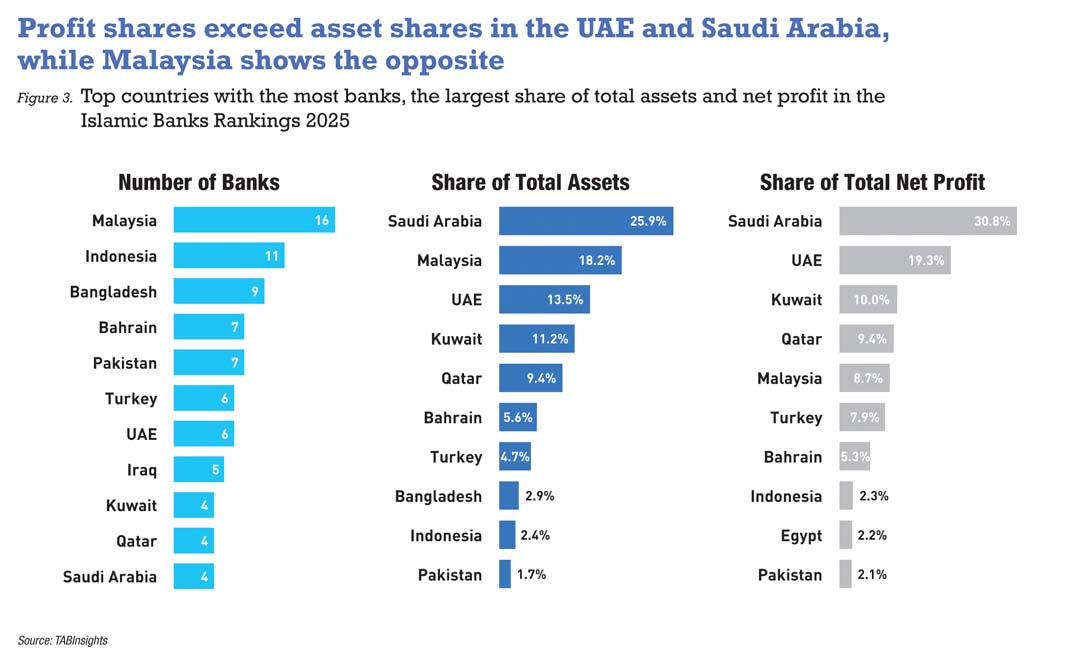

Saudi Arabia leads, with its four banks in the rankings accounting for 25.9% of total assets and 30.8% of total net profit of the top 100 Islamic banks. Banks from the UAE, Kuwait and Qatar represent 13.5%, 11.2% and 9.4% of total assets, contributing 19.3%, 10.0% and 9.4% of total net profit, respectively. Notably, the UAE and Saudi Arabia report profit shares that significantly exceed their asset shares, highlighting stronger profitability relative to peers.

Islamic banks in Saudi Arabia continue to expand their market presence through extensive retail networks and large financing portfolios, supported by stable, low-cost deposits and sustained demand for government and infrastructure-related financing. In the UAE, Islamic banks have strengthened their balance sheets through international expansion, sukuk issuance and Islamic wealth management, broadening both profitability and diversifying income sources.

Kuwaiti banks have built a solid regional presence by combining retail and corporate operations with selective international expansion, focusing on stable growth and diversified funding sources. Qatari banks focus on corporate and project financing—particularly in the energy, infrastructure and utilities sectors—using Sharia-compliant structures that support the country’s economic diversification and long-term development.

Asia consolidates as a key growth hub

Southeast Asia and South Asia are solidifying their position as the second-largest regional bloc for Islamic banking. Malaysia, Indonesia, Bangladesh and Pakistan contribute 16, 11, 9 and 7 banks to the ranking, respectively, while Brunei, Maldives, Sri Lanka and Thailand each have one. Asian Islamic banks operate at a smaller scale than their Middle East peers, yet continue to advance financial inclusion and diversify funding structures.

Malaysia and Indonesia anchor Southeast Asia’s Islamic banking system, supported by policy initiatives, consumer demand and technological innovation. Malaysia’s dual banking system has achieved a high degree of balance between Islamic and conventional financing, with Islamic banking accounting for nearly half of total financing, driven by the expansion of Shariah-compliant credit products. The country’s 16 Islamic banks account for 18.2% of total assets and 8.7% of total net profit among the top 100 Islamic banks, reflecting a large market with relatively lower profitability. The sector continues to pursue innovation in areas such as Islamic credit cards, emerging digital deposits and sustainability-linked financing. Although the regulatory framework is robust, liquidity infrastructure is still evolving to address challenges including market fragmentation and cross-border harmonisation.

Indonesia, with a large Muslim population and rising financial inclusion, is expanding its Islamic banking footprint to tap growing demand. The merger of state-owned Islamic banks into Bank Syariah Indonesia enhanced scale and efficiency, while digital channels have widened outreach to underbanked populations and lowered customer acquisition costs. The 11 Indonesian Islamic banks account for 2.4% of total assets and 2.3% of total net profit of the top 100 Islamic banks, signalling a market that continues to develop in depth and scale.

In South Asia, Islamic banking is advancing through both policy actions and market initiatives. Pakistan has positioned Islamic finance as a national objective, with Islamic banking accounting for about one-fifth of total banking assets and roughly one-quarter of total deposits, underscoring its expanding presence and government support. The country aims to shift to a fully Shariah-compliant banking system by 2027, backed by political commitment, regulatory guidance from the State Bank of Pakistan and Shariah governance standards issued by the Securities and Exchange Commission. Challenges remain, including coordination among institutions, public perception and converting government and commercial debt into Shariah-compliant formats. Pakistan’s seven Islamic banks in the rankings hold 1.7% of total assets and 2.1% of total net profit of the top 100 Islamic banks, showing relatively higher profitability among regional peers.

In Bangladesh, the nine Islamic banks in the rankings account for 2.9% of total assets of the top 100 Islamic banks and reported a combined net loss for FY2024. The sector faces structural issues, including governance weaknesses, rising non-performing financing and liquidity pressures in several large banks, prompting regulatory scrutiny and central bank intervention. Profitability remains constrained as asset quality deteriorates and funding costs increase. Strengthening governance, risk management and transparency will be essential to restore confidence and support sustainable sector development.

Al Rajhi Bank remains the largest worldwide

Thirty-five banks surpassed the $10 billion asset threshold in FY2024, up from 34 the previous year, including 19 from the Middle East, 13 from Asia and three from Europe. In addition, 51 banks held assets between $1 billion and $10 billion, two more than last year.

On profitability, seven banks posted net profits exceeding $1 billion, unchanged from the previous year. This group includes Al Rajhi Bank, Dubai Islamic Bank, Kuwait Finance House, Abu Dhabi Islamic Bank, Alinma Bank and Qatar Islamic Bank from the Middle East, and Kuveyt Türk Katilim Bankasi from Europe. Maybank Islamic generated the largest net profit among Asian Islamic banks, at $621 million in FY2024. Meanwhile, 30 banks earned between $100 million and $1 billion, compared with 27 last year, while eight banks recorded net losses.

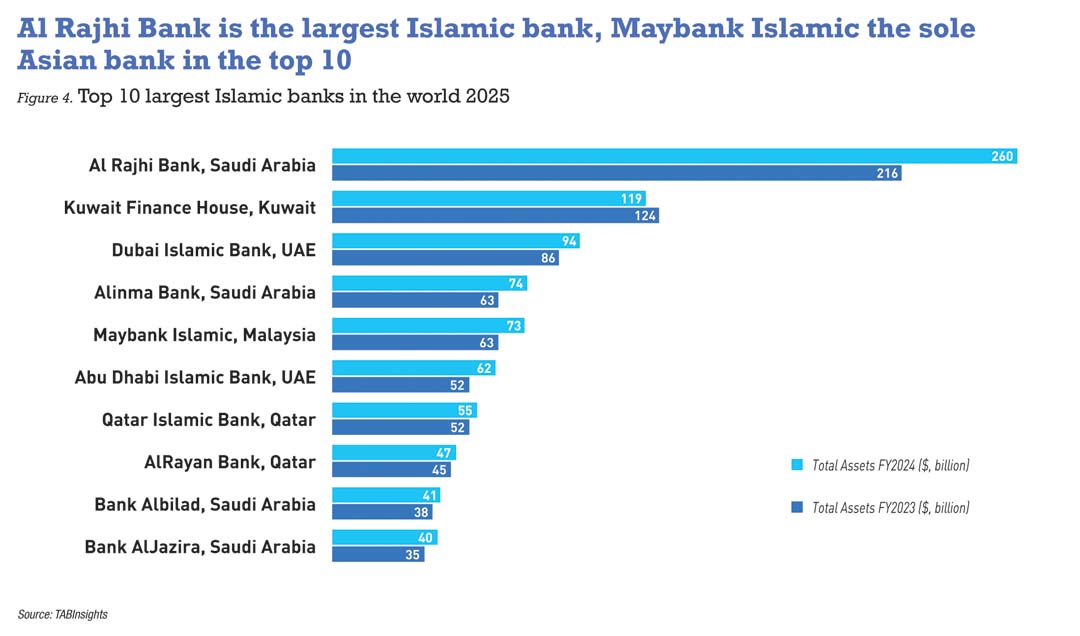

The 10 largest Islamic banks globally include four from Saudi Arabia, two from the UAE, two from Qatar and one each from Kuwait and Malaysia. With $260 billion in assets as of FY2024, Al Rajhi Bank remains the largest Islamic bank worldwide. Its asset growth accelerated from 6.1% in FY2023 to 20.6% in FY2024, the fastest among the top 10, supported by expansion in both financing and investment portfolios. Alinma Bank, Bank Albilad and Bank AlJazira from Saudi Arabia occupy the fourth, ninth and tenth positions, recording asset growth of 16.9%, 8.3% and 14.9% in FY2024.

Kuwait Finance House holds the second position, following enhanced scale from its merger with Bahrain-based Ahli United Bank in FY2022. Its total assets reached $119 billion in FY2024, down 3.4%, mainly due to the sale of KFH-Bahrain to Al Salam Bank in May 2024 and foreign exchange movements. Ahli United Bank has been renamed Kuwait Finance House - Bahrain, marking a strategic transformation that further consolidates its position in Islamic banking.

Dubai Islamic Bank and Abu Dhabi Islamic Bank rank third and sixth. Dubai Islamic Bank’s assets rose 9.7% to $94 billion in FY2024, while Abu Dhabi Islamic Bank expanded 17.2% to $62 billion. Qatar Islamic Bank and Al Rayan Bank hold the seventh and eighth positions with assets of $55 billion and $47 billion.

Maybank Islamic ranks fifth, with $73 billion in assets at the end of FY2024, and is the only Asian institution among the global top 10. Its assets grew 13.6% in FY2024, following a 1% decline in the previous year due to a reduction in cash and cash equivalents. Among the top 10 Asian Islamic banks, seven are from Malaysia and one each from Bangladesh, Indonesia and Pakistan. Bank Syariah Indonesia, Islami Bank Bangladesh and Meezan Bank remain the largest institutions in their respective markets.

Saudi Arabian Islamic banks maintain the highest overall strength

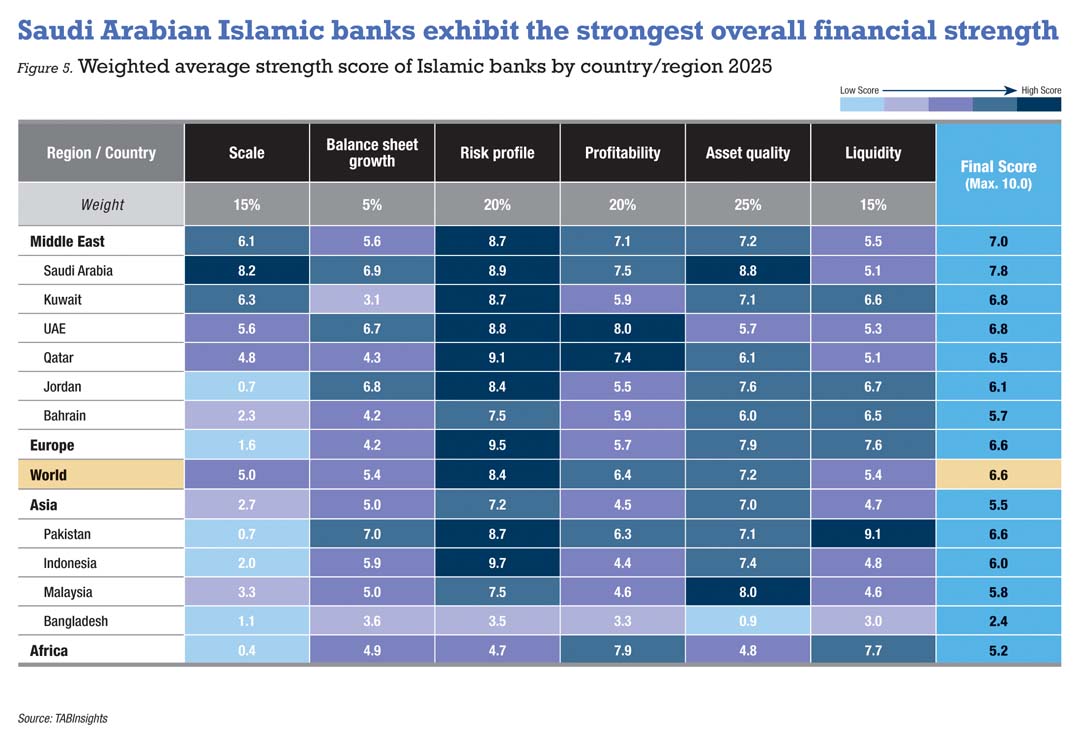

The strongest Islamic banks ranking shows that Saudi Arabian Islamic banks continue to record the highest overall strength. The ranking employs a transparent scorecard covering six dimensions—scale, balance sheet growth, risk profile, profitability, asset quality and liquidity—across 14 metrics to provide a rigorous comparison of global Islamic banking performance.

Islamic banks in the Middle East achieved the highest asset-weighted average strength score of 7.0 out of 10, compared with 5.5 in Asia. Middle Eastern Islamic banks outperformed their Asian counterparts across all dimensions, particularly in scale and profitability. In FY2024, the average ROA for Middle Eastern Islamic banks reached 1.9%, while Asian banks reported a much lower 0.9%. The average cost-to-income ratio (CIR) for Islamic banks in Asia stood at 46.6%, considerably higher than the 33.6% recorded by Middle Eastern banks. The average gross non-performing financing (NPF) ratio for Middle Eastern Islamic banks improved from 2.9% in FY2023 to 2.6%, while that of Asian banks rose sharply from 2.5% to 6.4%, due largely to the situation in Bangladesh.

Saudi Arabia recorded the highest average strength score at 7.8, with Kuwait and the UAE at 6.8 and Qatar at 6.5. Saudi Arabian Islamic banks lead in asset quality, UAE banks in profitability, Kuwaiti banks in liquidity and Qatari banks in risk profile, assessed by capitalisation and loan-to-deposit ratio.

UAE and Saudi Arabian Islamic banks recorded ROA of 2.5% and 2.1% in FY2024, compared with 1.6% for Qatar and 1.4% for Kuwait. Saudi Arabian institutions reported a low average gross NPF ratio of 0.9%, improving from 1.1% in the previous year, while their average provision coverage ratio stood at 170%. By comparison, Kuwaiti banks saw their gross NPF ratio rise from 2.2% to 2.6%, and UAE banks recorded a still-elevated 4.3%, down from 5.9% in FY2023. Islamic banks in these countries maintained solid capitalisation, with Qatari banks posting the highest average capital adequacy ratio (CAR) of 20.9%, followed by Saudi Arabia at 19.4%, Kuwait at 19.2% and the UAE at 17.7%. Saudi Arabian and Qatari banks had comparatively lower liquidity than those in Kuwait.

In Asia, Pakistani Islamic banks showed greater overall financial strength than their counterparts in Indonesia, Malaysia and Bangladesh. Pakistani banks performed better in balance sheet growth, profitability and liquidity, while Indonesia led in risk profile and Malaysia in scale and asset quality. Several Bangladeshi Islamic banks, including Islami Bank Bangladesh, First Security Islami Bank, Social Islami Bank and Global Islami Bank, have been facing considerable challenges, with weakening asset quality, profitability and capital buffers.

Pakistani Islamic banks recorded notable profitability, with an average ROA of 2.3% in FY2024, surpassing 1.6% for Indonesian banks and 0.8% for Malaysian banks. They also maintained robust liquidity, with an average liquidity coverage ratio of 264% and a net stable funding ratio of 182%. Indonesian Islamic banks, however, recorded stronger capitalisation with an average CAR of 24.3% in FY2024, compared with 18.9% for Malaysian banks and 16.1% for Pakistani banks.

The average gross NPF ratio for Malaysian banks improved to 1.3%, although the average provision coverage ratio fell to 120% from 134% in the previous year. For Islamic banks in Indonesia and Pakistan, the average gross NPF ratios were 2.1% and 5.9%, while their provision coverage ratios remained higher than Malaysia at 184% and 136%. Bangladeshi Islamic banks, however, saw a severe decline in asset quality, with the average gross NPF ratio rising above 40%, compared with 5.2% in the previous year.

Al Rajhi Bank stands out in profitability, capitalisation and asset quality

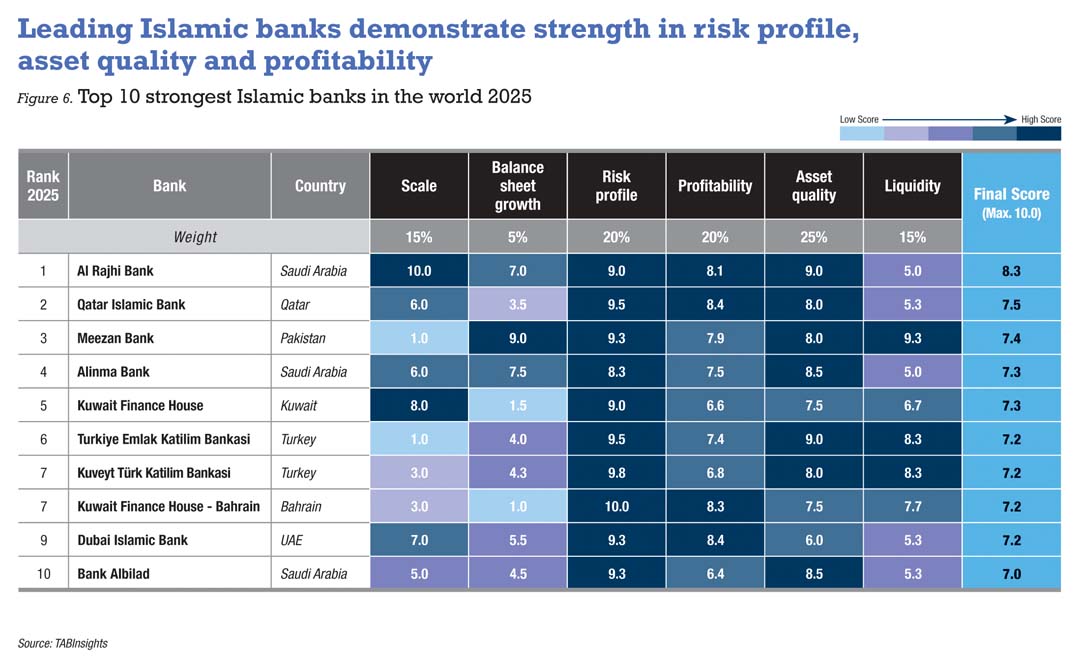

Al Rajhi Bank, Qatar Islamic Bank and Meezan Bank lead this year’s ranking of strongest Islamic banks, while Kuwait Finance House and Dubai Islamic Bank place fifth and ninth. Al Rajhi Bank retains its position as the strongest Islamic bank globally, with an overall strength score of 8.3. It combines Islamic finance principles with advanced digital innovation and a clear sustainability agenda, while strengthening coordination across its operations and subsidiaries through the “Harmonise the Group” initiative, reinforcing its capacity for sustained growth.

In FY2024, Al Rajhi Bank continued to expand its balance sheet, recording a 21% rise in total assets while broadening the funding mix through sukuk issuances and major syndicated financing deals. Its operating income grew by 16%, supported by cross-selling, with 42% of clients holding multiple products. This, along with disciplined cost management, contributed to the bank’s highest net profit since inception, with ROA rising to 2.3% and the CIR falling to 25%. In addition, the bank maintained solid asset quality, with a gross NPF ratio of 0.8% and a provision coverage ratio of 159%, and capital strength remained robust, with a CAR of 20.2%.

Qatar Islamic Bank, ranked second, has advanced its position in Islamic banking through sustainable growth, enhanced digital capabilities and deeper customer engagement. By strengthening its core businesses, broadening revenue streams and leveraging technology and customer-focused initiatives, it achieved a record net profit in FY2024, with a ROA of 2.4% and non-financing and investment income accounting for 39% of total income. Operational excellence remained a key feature, with a CIR of 17%, placing the bank among the most efficient globally. Meanwhile, its capital strength remained solid, with a CAR of 20.9%.

In Asia, Meezan Bank, Maybank Islamic and Bank Syariah Indonesia are the top three strongest Islamic banks. Meezan Bank delivered solid balance sheet growth, profitability and liquidity, while Bank Syariah Indonesia recorded firmer capitalisation, and Maybank Islamic gained prominence for its scale and asset quality.

All three banks recorded higher ROA in FY2024. Meezan Bank posted 3.1%, ahead of Bank Syariah Indonesia at 1.9% and Maybank Islamic at 0.9%. Meezan Bank reported a lower ratio of non-financing and investment income to total income than the other two banks. Meezan Bank also improved its CIR from 28.8% in FY2023 to 26.9%, below Maybank Islamic’s 35.1% and Bank Syariah Indonesia’s 54.4%. Bank Syariah Indonesia increased its CAR from 21% in FY2023 to 21.4% in FY2024, compared with 20.6% for Meezan Bank and 16.6% for Maybank Islamic. Maybank Islamic recorded a lower gross NPF ratio of 1.1%, compared with Meezan Bank’s 1.6% and Bank Syariah Indonesia’s 1.9%.

Capital strength and liquidity are key to board oversight

As Islamic banks expand in scale and sophistication, effective board oversight has become a critical driver of financial resilience and long-term sustainability. The rankings highlight both financial performance and governance practices that support balance-sheet strength and sustainable growth. They provide a comprehensive view of how boards shape outcomes across the sector. Leading banks, including Al Rajhi Bank, Kuwait Finance House, Dubai Islamic Bank and Qatar Islamic Bank, show how disciplined governance and strategic board oversight reinforce resilience, offering guidance for directors navigating evolving risks.

Top-performing Islamic banks maintain robust capital and liquidity, supported by stable funding, enabling them to withstand market shocks while pursuing growth. Saudi, Kuwaiti and Qatari banks reported average CAR above 19% in FY2024, with liquidity positions meeting Basel III standards.

Effective board oversight shapes these outcomes through strategic capital planning, diversified funding and operational efficiency. Al Rajhi Bank issued a $1 billion Sustainable AT1 Sukuk and secured $4.6 billion in syndicated and bilateral deals. Kuwait Finance House launched a post-merger Capital Management Program and issued a $1 billion Senior Unsecured Sukuk. Qatar Islamic Bank attracted global investors with a $750 million Sukuk. Dubai Islamic Bank aligned capital with Environmental, Social and Governance (ESG) objectives through a $1 billion Sustainable Sukuk. Al Rajhi Bank also approved a 65% stake in Drahim and established the open banking platform Neotek, supporting efficient capital allocation across business units.

Leading banks ensure liquidity frameworks comply with Basel III requirements and maintain stable funding structures. Kuwait Finance House implemented country-specific contingency plans for subsidiaries and participated actively in international Sukuk markets. Dubai Islamic Bank enhanced real-time monitoring, while Qatar Islamic Bank’s Asset and Liabilities Committee oversees liquidity buffers. These measures, including stress testing, scenario analysis and contingency planning, embed forward-looking governance.

Capital and liquidity planning have evolved from regulatory exercises into core strategic disciplines. Leading banks align capital adequacy with risk appetite and growth strategies while ensuring liquidity frameworks are stress-tested and funding diversified. Independent committees should lead annual reviews of stress tests and contingency plans to address emerging risks, including interest rate shifts, geopolitical shocks and Sukuk market disruptions.

Boards manage credit quality and concentration risk

Asset quality across the Middle East Islamic banking sector improved in FY2024, highlighting the critical role of board-supervised risk frameworks. Although Middle East banks historically recorded higher NPF ratios than their Asian counterparts, severe challenges in Bangladesh pushed its Islamic banks’ gross NPF ratio above 40%, up from 5.2% the previous year. This underscores the urgent need to strengthen governance, risk management and transparency to restore confidence and support sustainable growth.

Leading Middle East banks demonstrate strong board oversight of NPF and credit concentration through diversified financing, industry-specific limits, multi-country operations and sectoral exposure caps. Al Rajhi Bank separates its Credit Risk function under a Chief Credit Officer to ensure objective credit decisions, shifts toward lower-risk retail products and diversifies across sectors. Kuwait Finance House applies a three-lines-of-defence model with automated rating systems, early warning mechanisms and stress testing to manage sectoral and geographic exposure. Qatar Islamic Bank manages risk through conservative underwriting and Sharia-compliant collateral, supported by AI-driven document verification and fraud management systems. Dubai Islamic Bank’s “DRIVE” strategy integrates sectoral and geographic diversification with real-time credit monitoring and Sharia compliance, reinforced by core banking system upgrades in FY2024.

Effective governance demands a proactive, forward-looking culture. Leading institutions maintain independent risk-review structures, early warning mechanisms and region-specific credit policies, leveraging AI-driven credit models to detect stress early. Portfolio-level assessments are complemented by cross-sector and cross-geography monitoring, ensuring that credit risk management remains strategic, Sharia-compliant and aligned with long-term resilience objectives.

Boards drive sustainable profitability through strategy and investment

Global Islamic banking has seen profitability grow steadily. Profitability increasingly reflects board strategies that align growth with risk appetite, integrate revenue diversification, drive technology investment and enforce cost discipline, prioritising long-term sustainable returns.

Effective boards guide growth while maintaining stability and diversifying revenue streams. Al Rajhi Bank broadened retail segments and strengthened lending to small and medium-sized enterprises (SMEs) and corporate clients under its “Harmonise the Group” strategy. It also mandated cross-selling, resulting in 42% of customers using multiple products. Qatar Islamic Bank maintained conservative underwriting, supporting steady deposit and financing growth. Dubai Islamic Bank expanded geographically and diversified SME and corporate business under its 2022–2026 “DRIVE” strategy. Kuwait Finance House strengthened post-merger integration and unified systems to support growth and efficiency.

Cost discipline remains central to profitability strategies. Al Rajhi Bank achieved a CIR of 25% through centralisation, automation and digital solutions, automating 52% of back-office processes. Kuwait Finance House realised post-merger cost synergies and unified systems to eliminate redundancy. Qatar Islamic Bank maintained a sector-low CIR of 17% through digital channels and branch optimisation. Dubai Islamic Bank cut manual workflows and eliminated legacy system costs, keeping CIR below 30%.

Digital transformation has become a core board priority, enhancing efficiency, risk management and sustainable growth. Al Rajhi Bank replaced legacy systems with real-time digital cores and implemented a five-year digital roadmap. Kuwait Finance House integrated over 80 systems and deployed artificial intelligence, machine learning and robotic process automation. Qatar Islamic Bank invested in AI-driven credit tools and digital platforms, achieving 99% digital transaction share. Dubai Islamic Bank upgraded its core banking system for real-time credit monitoring, AI-powered default prediction and fintech partnerships.

Sustainable efficiency now defines best practice, aligning cost management with long-term transformation rather than short-term savings. This includes approving targeted investments in digital technology, automation and operational enhancements to strengthen risk management, customer experience and revenue generation. Committees should review key profitability drivers quarterly and ensure alignment between strategic goals and execution, with savings and digital initiatives supporting long-term resilience, competitiveness and growth.

Islamic banks strengthen governance to sustain growth and profitability

The TABInsights 2025 Islamic Banks Rankings underscore the resilience and growth of global Islamic banking. Middle Eastern banks, especially in Saudi Arabia, the UAE, Kuwait and Qatar, lead in scale, profitability and financial strength, while Asian markets, including Malaysia, Indonesia and Pakistan, are emerging growth hubs, expanding financial inclusion and market sophistication.

Disciplined board oversight, strategic capital and liquidity planning, and proactive risk management are critical to sustaining performance. Digital transformation, cost discipline and revenue diversification enhance profitability, while technology-enabled credit monitoring and operational efficiency reinforce resilience. Boards must move beyond compliance-driven oversight to forward-looking governance, embedding regular stress testing, contingency planning, and independent review of credit quality and concentration risk.

Balancing operational efficiency with strategic investments ensures long-term sustainability. Integrating governance into every decision strengthens stakeholder trust, aligns strategy with capital and culture, and supports Shariah-compliant innovation—enabling Islamic banks to deliver stable, sustainable returns while meeting the evolving financial needs of global markets.

View rankings for Largest Islamic Banks and Strongest Islamic Banks.