Global transaction banking (GTB) has rapidly adapted to changing market dynamics, embraced innovation, and forged strategic partnerships to build thriving corporate treasuries. Based on the TABInsights Asia Pacific Transaction Finance Survey 2024, transaction banking—including cash and liquidity management and trade finance—contributed approximately 40-45% of wholesale and corporate bank revenues for regional banks. For global banks, this contribution was about one-third, underscoring how these fee-based services have become a crucial driver of growth for financial institutions.

In an elevated interest rate environment, GTB revenue growth was significantly driven by increased net interest income (NII), which boosted banks’ cash management revenues across the region. Survey responses indicated that cash management revenues contributed up to 70% of transaction banking revenue. From a trade finance perspective, despite strong trade volumes, higher interest rates have led to a decline in trade values, disrupting the usual correlation between trade volumes and financing, and resulting in reduced trade financing.

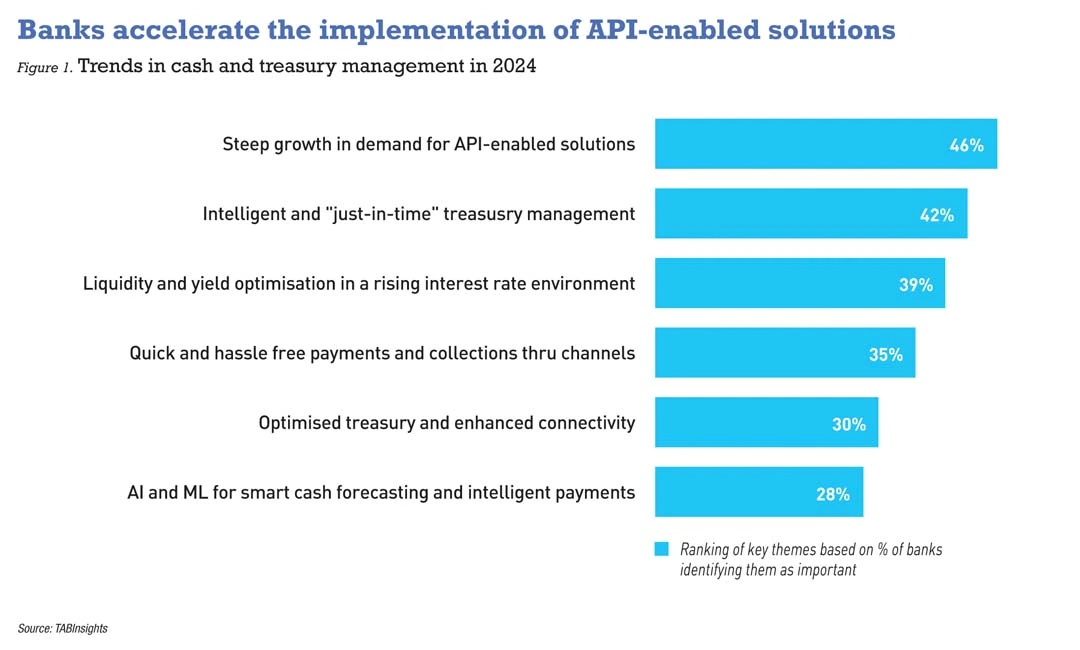

To reduce external borrowing costs, corporates demanded greater real-time access and visibility across account balances and cross-border transactions. With a significant focus on liquidity optimisation, efficiency gains and real-time insights to drive business decisions, treasurers sought digital cash management solutions. This led cash management service providers to launch or enhance solutions that optimise treasury functions and expand corporate connectivity. Banks accelerated the implementation of application programming interfaces (APIs) to incorporate transaction banking services into their enterprise resource planning (ERP) and treasury management systems. These APIs enable seamless payment processing, account management, and transaction reconciliation. Underpinned by artificial intelligence (AI) and machine learning (ML), smart cash-forecasting solutions and intelligent payments routing also emerged as innovative solutions.

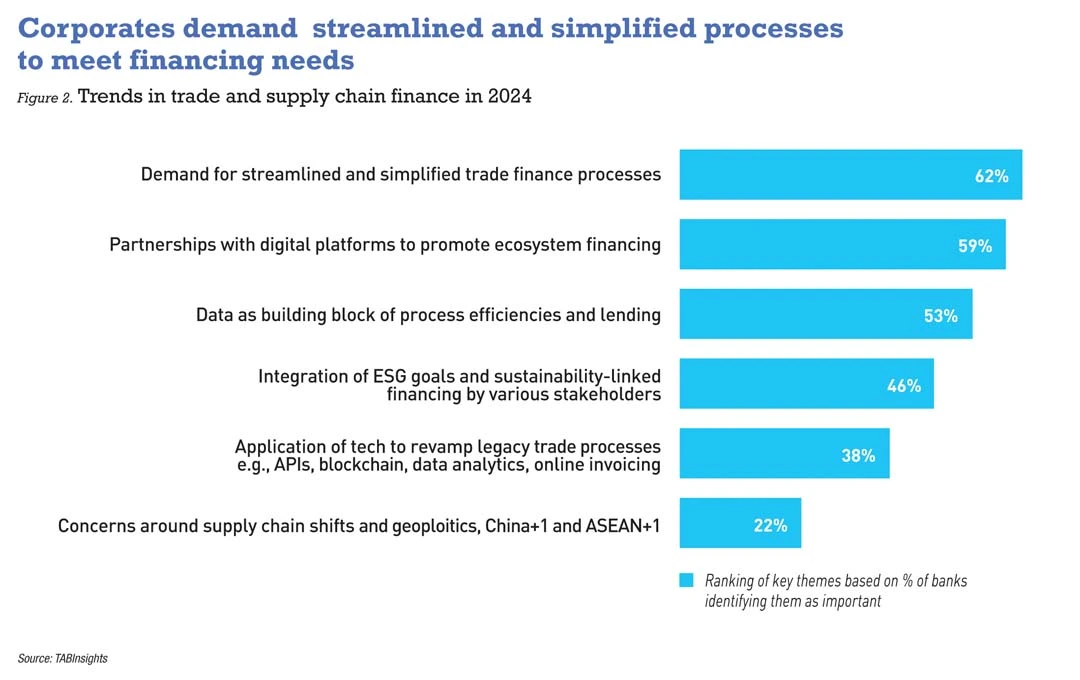

In trade and supply chain finance, banks are forging partnerships with platforms to directly integrate customers into buyer-seller networks. Rising digital e-commerce in the region is creating significant opportunities for banks to serve the merchant solutions space. The scope of trade finance digitalisation is expanding beyond digital transmission of trade documents, yet it still faces significant challenges. The lack of standardisation in data, electronic documents, forms, and processes across different trade platforms and networks creates barriers to digitalisation. Comprehensive frameworks, such as the Digital Standards Initiative (DSI), along with the leveraging of data, promise further integration of physical and financial information.

Supply chain shifts have accelerated as China+1 and ASEAN+1 strategies become more prominent, with multinationals (MNCs), and large Asian corporates diversifying their procurement, production, and sales networks. Driven by regulatory push and stakeholder awareness, the demand for embedding sustainability into supply chains and trade financing workflows has gained momentum. Banks are helping clients on their sustainability journeys through the launch of sustainable transaction products and advisory services.

Asia’s cash management banks accelerate API-enabled solutions adoption

In 2023 and the first half of 2024, cash and treasury management faced challenges from high interest rates and inflation. Corporates encountered higher borrowing costs and lower deposit yields, straining their ability to manage cash and liquidity effectively. Coupled with Asia’s fragmented exchange control and regulatory environment that restricts the free flow of cross-border funds, corporates turned to domestic and cross-border liquidity structures and centralised solutions to address their overall corporate treasury objectives.

To address clients’ needs, banks in Asia implemented solutions like cross-border multibank sweep services, notional pooling, interest optimisation and enhancement. United Overseas Bank (UOB) implemented optimised liquidity structures to support customers’ business expansion into new markets using internal group cash. To meet cross-border cash management needs, UOB incorporated multibank sweep services, allowing customers to extract surplus liquidity and consolidate it centrally at their headquarters.

To efficiently manage clients’ cash positions, Bank of America (BoA) implemented notional pooling, enabling customers to offset debit and credit balances in the same or different currencies within a country. This approach enabled them to offset negative positions without incurring additional foreign exchange (FX) costs, thereby minimising interest expenses.

Bank of China (Hong Kong) integrated global cash, liquidity, and treasury management solutions. It harmonised liquidity structures centrally and enabled customers to streamline account processes and consolidate global account information using its extensive network. Its iGTB platform, supported by host-to-host Connect and API services, delivered robust solutions across the full spectrum of transaction banking services.

Real-time data access has become essential for intelligent treasury management. Treasurers sought advanced digital capabilities to automate their payables, receivables, reconciliation, and invoicing for «just-in-time» treasury. To support treasury’s operations holistically, Deutsche Bank embarked on the data driven treasury (DDT) initiative. Through partnerships with global firms, DDT combines account data from its own platforms, third-party banks, and ERP-based data to offer state-of-the-art technology solutions to corporate treasurers. Customers can access real-time bank data through usable dashboards, and leverage data to improve liquidity visibility and achieve accurate cash flow predictions.

APIs have emerged as key to cash and treasury management transformation. Banks reported significant growth in demand for API services and API-enabled transaction volumes. Deutsche Bank supported a large global consumer goods company in optimising the management of US dollar and local currency balances through an API-led target balancing solution, minimising manual intervention and unexpected currency exposures.

UOB delivered API-led solutions to support a wide spectrum of instant banking services. It enhanced its payment services API for government-related payouts, facilitating cash and voucher disbursements. This enhancement increased support for more payment rails and boosted the platform’s transaction-per-second (TPS) capacity. Similarly, Kotak Mahindra Bank offered APIs for rapid onboarding and handling high-volume transactions while maintaining a higher TPS. The solution empowered new-age companies, emerging corporates, and payment aggregators to seamlessly process transactions round-the-clock with improved TPS and minimal turnaround time.

OCBC provided a comprehensive API suite to facilitate seamless collection processes for businesses and their end-users. For instance, its virtual account API enabled easy identification of payment sources, transaction refund APIs allowed businesses to refund payers in cases of double debits or disputes. Additionally, the PayNow quick response (QR) API allowed for direct payments to businesses. Mizuho Bank’s API-enabled virtual account solutions assisted customers with real- time notifications of received funds. When paired with payment gateway solution, these APIs facilitated the seamless receipt of reconciled funds.

Hang Seng Bank responded to heightened interest rate and FX risks by enhancing customers’ working capital and liquidity management. It integrated collection solutions with FX APIs, faster payment system QR codes, and a liquidity management platform to optimise operating cash and yields.

The landscape is witnessing the convergence of technology and traditional banking practices, with APIs and ML being used to automate and predict cash flow processes. Leading global banks are capitalising on advancements in technology to enhance cash flow management. Bank of America employed AI to refine cash flow predictions through its CashPro and Intelligent Receivables (iREC) solutions.These tools combine payment and remittance data to match payments with clients’ open accounts receivable, ensuring that relevant credit and payments are processed promptly.

Trade digitalisation continues despite global headwinds

Amid high working capital costs, key trade financing banks have focused on digitisation, sustainability, and risk management. The quest for operational efficiency—including automation, accuracy, and connectivity with ecosystem partners—has led banks to offer digital solutions that streamline and simplify trade processes.

Trade finance involves managing numerous documents, making compliance with trade regulations complex, particularly due to constantly changing regulations. To mitigate high risks associated with physical documents, banks have partnered with trade platforms to digitise aspects of customers’ financing and documentation journeys.

OCBC offered document e-presentation services to mitigate the risks of document loss during transit. This initiative reduced turnaround times by up to five days for receiving payments from buyers. The bank also digitised the issuance of banker’s guarantee (BG) for 47 government agencies in Singapore, shortening the BG application process to less than three minutes.

To mitigate paper-based inefficiencies in traditionally document-heavy industries such as bunkering, construction and infrastructure, UOB enhanced its financial supply chain management (FSCM) capabilities on the UOB Infinity FSCM platform. The enhanced regional digital trade finance platform connects buyers, suppliers, and distributors within one ecosystem, facilitating financing requests for accounts receivable and payable. Users can seamlessly upload and manage documents, such as invoices and purchase orders from a single sign-in, gaining visibility into transactions across regional accounts. The enhanced platform transformed customers’ procurement, invoicing and collection practices.

Data continues to be the building block of digital trade finance. Although data transfer remains a challenge, some banks are applying AI, optimal character recognition and natural language processing to extract and structure data from physical documents. Deutsche Bank streamlined paper-heavy processes using back-end technologies, such as intelligent document recognition to digitise data. This lays the groundwork for advanced compliance analytics tools like named entity recognition, to automate regulatory checks with minimal manual input. Standard Chartered integrated AI and ML models for name and transaction screening to enhance compliance with regulations. It leveraged AI in data reconciliation and managing unstructured data to process large volumes of invoices and trade documentation quickly.

In addition to previously mentioned use cases, banks are leveraging fintech partnerships in conjunction with real-time data to drive innovation. The rise of digital e-commerce in the region presents significant opportunities for banks to enhance their merchant solutions. As traditional businesses and new digital marketplaces seek partners to improve transaction flows, banks are forging partnerships with fintechs to better understand their merchant customers’ digital and lending needs. For example, HSBC collaborated with Dowsure Technologies, a cross-border e-commerce platform, to transform trade finance. Traditionally, trade finance requires extensive financial documentation and collateral, which can be barriers for smaller businesses seeking capital. Through this partnership, HSBC utilised real-time transaction data such as inventory sales, refund records and customer ratings to determine credit limits in real-time. This data-driven approach allowed HSBC to expand access to financing without the need for traditional financial statements or collateral.

However, a key hurdle in utilising data remains its transfer. A critical question is which standards or APIs will be crucial for transitioning from documents to data. This has driven the push for a unified, interoperable infrastructure using APIs that support a common framework to streamline trade processes. Initiatives by Swift and the International Chamber of Commerce (ICC) have established industry standards for APIs, improving data flow and reducing friction. Supporting these standards are legal reforms that foster trust such as the adoption of the Electronic Trade Documents Act in the UK, based on the UN’s Model Law on Electronic Transferable Records (MLETR). This law facilitates digital document transfers using electronic transferable records, helping bridge the $2.5 trillion trade finance gap estimated by Asian Development Bank (ADB) in 2022. The majority of the G7 has adopted MLETR, with many emerging markets considering it.

As sustainability evolves into a fundamental driver of corporate strategy, banks are integrating environmental, social, and governance (ESG) factors into lending decisions and sustainability in supply chain financing (SCF). Regional banks are significantly expanding their green and sustainable trade finance (GSTF) offerings. Aligned with Singapore’s sustainability goals, UOB has simplified GSTF adoption by embedding sustainability into its customers’ existing commercial operations and trade financing workflows. UOB utilised ESGpedia, a registry for ESG data and technology, to access green certification information for client projects. It also leveraged the traceability of digital document exchange to extend green and sustainable trade financing. Maybank advanced sustainable finance by implementing a green trade facility for a key electric vehicle customer, aligning with Malaysia’s drive toward greener mobility. Deutsche Bank set-up a dedicated team of ESG subject matter experts in the region to drive sustainable deals. This team focuses on funding long-term, large ticket ESG-linked letters of credit (LCs) and guarantee agreements, especially in renewable energy.

Additionally, banks are incentivising suppliers to meet stringent sustainability standards through preferential financing rates. They are also integrating other metrics into supply chain operations to support these efforts. Deutsche Bank launched its first sustainability-linked payables finance programme in Asia with BASF in 2024. The programme focuses on BASF’s operations—one of the world’s largest chemical companies in China— and links financing terms to the ESG performance of suppliers, promoting sustainable practices throughout the supply chain. Suppliers are assessed through internationally recognised rating platforms, and those who achieve or surpass sustainability goals receive more favourable financing terms.

In partnership with the Linklogis platform, Standard Chartered assessed its suppliers for ESG-compliance and offered favourable financing terms to those who met sustainability targets. Similarly, CTBC Bank in Taiwan developed ESG portfolio lending to address funding challenges and incentivise sustainable transformation for SMEs, where large enterprises’ “ESG deposits” help subsidise “ESG loans” for their supply chain vendors.

As geopolitics realigns supply chains, trade flows are shifting between key corridors such as China and ASEAN, India, and Mexico. These changes are driving new investments and capital expenditures in these regions. Bolstered by local infrastructure spending and new manufacturing facilities, demand for trade and working capital financing is expanding. Smaller and mid-market players are becoming increasingly integrated into global value chains, as the US and Europe diversify from China to ASEAN and India. This diversification creates new opportunities for smaller businesses to engage in global trade. Key players with strong regional footprints, innovative edge, and the capacity to meet the rising demand for seamless and hassle-free financing will dominate the market.